Key Findings:

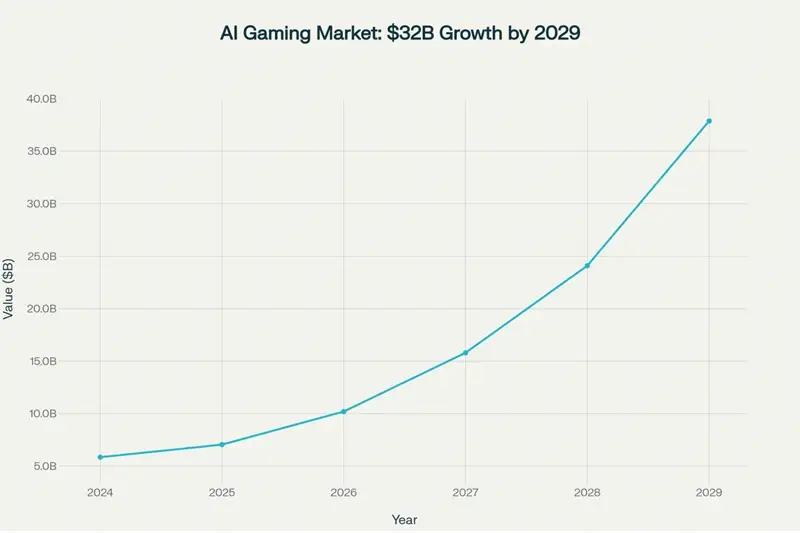

The global gaming industry is undergoing a fundamental transformation driven by artificial intelligence (AI). Once considered an experimental tool, AI has rapidly evolved into a critical growth engine that is reshaping how games are designed, delivered, secured, and experienced. By 2029, the artificial intelligence in gaming market is projected to expand from $5.85 billion in 2024 to $37.89 billion, reflecting an extraordinary 547% total growth and a compound annual growth rate (CAGR) of 20.54% [Fortune Business Insights, 2024]. In parallel, generative AI alone is expected to more than double, rising from $1.81 billion in 2025 to $4.18 billion in 2029, supported by its disruptive applications in content creation, adaptive storytelling, and intelligent game design [Research and Markets, 2024].

This expansion occurs within a broader industry boom, as the total global gaming market is set to grow from $225.28 billion in 2025 to $424.14 billion in 2029 [Precedence Research, 2025]. The penetration of AI will also see a significant lift, increasing from 3.1% in 2025 to almost 9% by 2029, boosting AI into a core technology and not just an add-on [Technavio, 2025]. But importantly, it is AI’s confluence across these hot areas—fraud detection, player personalization, and generative content creation—that is delivering “game-changing” value that can effectively solve existing pain points for the industry while opening up new opportunities in monetization and engagement.

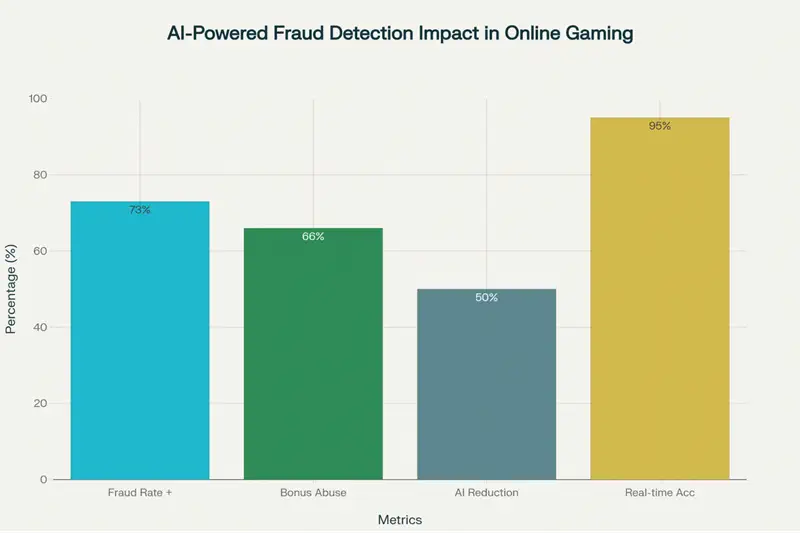

It is also particularly timely for this AI revolution, with increased regulatory scrutiny. The global market is confronted with ever more pervasive limitations in real-money gaming, most recently epitomized by India’s banning a $25 billion RMG market in 2025 [Niko Partners, 2025]. In such an environment, operators are looking at AI both as a key driver of compliance and a driver for sustainable growth. AI-driven fraud detection systems, for example, are already achieving 95% accuracy rates in detecting fraudulent activities, reducing compliance costs by up to 45%, and cutting fraud-related losses by as much as 50% [SDLC Corp, 2025].

Beyond security and compliance, AI is fundamentally altering the player experience. Personalized gaming environments powered by machine learning are boosting player satisfaction by 34%, while AI-optimized promotions have delivered revenue increases of up to 28% [PureSoftware, 2024]. Generative AI technologies are also reducing development costs by up to 52%, enabling studios to scale content output and experiment with immersive features like adaptive narratives and intelligent non-playable characters (NPCs) [Research and Markets, 2024].

North America currently leads the global AI gaming market with a 40% market share valued at $2.82 billion in 2025, projected to reach $15.16 billion by 2029 [Fortune Business Insights, 2024]. But the largest uptick is anticipated in Asia-Pacific, where mobile-first behaviors and large digital-native populations will create AI-augmented gaming experiences at scale [Technavio, 2025]. Europe, on the other hand, using regulatory leadership and data protection, is dictating how AI will be adopted; Latin America and Africa are becoming new frontiers as capital flows change due to global policy [Niko Partners, 2025].

Altogether, the AI revolution in gaming is worth fifty-three years from now, at about $133.6 billion, is not only about minor innovation but a renaissance of how globally we can live, move, and have our being as far as all this gaming ecosystem is concerned [PureSoftware, 2024]. Those businesses and investors who pursue an AI-first approach today will be best placed to take advantage of the oncoming tsunami of technology and market disruption.

Gaming has become one of the fastest-growing sectors of the global digital economy – bigger than film, television, and music combined. From a niche pastime, it has developed into the leading /port form of entertainment, totaling more than 3.2 billion active players throughout the world by 2024 [Fortune Business Insights, 2024] and with a market expected to reach over $424 billion by 2029 [Precedence Research, 2025].

This exponential rise has been fueled by several converging factors: the proliferation of mobile devices, the rise of high-speed internet connectivity, the mainstream adoption of esports, and the integration of cloud-based distribution models [PureSoftware, 2024].

At the same time, the industry is navigating a complex regulatory landscape. Governments worldwide are tightening restrictions on real-money gaming, loot boxes, and advertising practices, with India’s $25 billion ban on real-money gaming in 2025 standing as one of the most dramatic policy interventions to date [Niko Partners, 2025]. These shifts highlight an urgent need for gaming operators and developers to find sustainable, compliant pathways to growth that do not rely solely on monetization practices now under scrutiny [Technavio, 2025].

Against this backdrop, artificial intelligence (AI) has emerged as both a disruptive force and a strategic enabler. Initially deployed for rudimentary functions such as pathfinding and opponent modeling, AI now permeates every layer of the gaming value chain. Today’s AI systems are capable of predictive analytics for fraud detection, real-time personalization of player experiences, adaptive difficulty balancing, and even generative content creation that reduces development costs and accelerates time to market [Research and Markets, 2024].

The convergence of gaming’s surging global demand with AI’s rapidly advancing capabilities has created a new inflection point for the industry. AI is no longer an experimental add-on but a foundational technology shaping how games are built, regulated, and monetized [PureSoftware, 2024]. This evolution represents not just a shift in operations, but a redefinition of what gaming can be: more secure, more personalized, and more immersive than ever before. As this report explores, the period from 2025 to 2029 will mark the transition of AI in gaming from a supporting role to a central growth driver, with profound implications for developers, operators, investors, and regulators worldwide [Precedence Research, 2025].

Market Dynamics and Growth Acceleration: The online gaming industry is no stranger to disruption. From the early rise of mobile-first platforms to the integration of blockchain and immersive XR experiences, every wave of innovation has left a lasting imprint on both operators and players [PureSoftware, 2024]. Yet few shifts have been as far-reaching as the integration of artificial intelligence. Today, AI has moved beyond being a support tool in the background to becoming a decisive force in shaping how games are designed, delivered, and regulated [Research and Markets, 2024]. The technology is no longer optional—it is emerging as the growth engine that will define the competitive dynamics of the next decade [Precedence Research, 2025].

This transformation is best understood through a close look at the numbers and the distribution of technology applications that are driving industry-wide adoption. These changes emphasize the necessity for gaming providers and developers to identify new or existing models of responsible, compliant growth that are not solely based on questionable monetization [Technavio, 2025].

In this new environment, AI is a disruptive force and strategic enabler. First used for simple tasks of pathfinding and opponent modeling, AI has now spread across the entire breadth of the gaming value chain. The AI of today can do predictive analytics for fraud detection, real-time player personalization, dynamic game balancing between segments of users, or in response to influxes of new players and the generation of content that doesn’t just save development costs but also helps speed up time-to-market [Research and Markets, 2024].

The meeting of gaming’s exploding worldwide market and AI’s rapid evolution has brought us to another inflection point in the industry. AI as a novel add-on is no longer an experimental feature of video games, but one of the foundational elements that affect how games are assembled, played, controlled, and sold [PureSoftware.com USA-India, 2024]. This progression is not just a change in how we operate, but a redefinition of what gaming itself can be — more secure, more personalized, and more immersive than ever.

As this report details, the horizon of 2025-29 will witness the shift of AI gaming from a secondary supporter to a primary engine, fundamentally changing the gambling developer, operator, investor, and regulator landscape globally [Precedence Research, 2025].

Disruption is nothing new to the online gaming industry. Mobile-first platforms to blockchain, from holistic mobility environments to immersive XR experiences, each wave of innovation has added an irrevocable impact on operators as well as players, of course [PureSoftware, 2024]. But few changes have been as sweeping as the addition of artificial intelligence. Today, AI is not only a backstage helper but also an effective driver for determining the design of games, providing game services, and supervising gaming practices [Research and Markets, 2024]. The technology is no longer a choice but the growth driver that will shape the competitive landscape of the next decade in [Precedence Research, 2025].

| Year | AI Gaming ($B) | Generative AI ($B) | Total Gaming ($B) | AI Penetration (%) |

|---|---|---|---|---|

| 2024 | 5.85 | 1.47 | 208.33 | 2.8 |

| 2025 | 7.05 | 1.81 | 225.28 | 3.1 |

| 2026 | 10.20 | 2.35 | 258.40 | 3.9 |

| 2027 | 15.80 | 3.05 | 296.20 | 5.3 |

| 2028 | 24.10 | 3.95 | 339.80 | 7.1 |

| 2029 | 37.89 | 4.18 | 424.14 | 8.9 |

The shift is most clearly seen through a deep examination of the figures and how technology applications are being deployed across the industry.

Between 2024 and 2029, the AI in gaming market is forecast to grow from $5.85 billion to $37.89 billion, representing a 547% expansion and a CAGR of 20.54% in the base case, with some aggressive forecasts reaching as high as 42.3% [Precedence Research, 2025; Research and Markets, 2024]. This growth trajectory is a direct result of technological convergence, where generative AI, fraud detection, and personalization systems are being applied across nearly every layer of the gaming value chain.

In parallel, the total global gaming market is expected to increase from $225.28 billion in 2025 to $424.14 billion in 2029 [Fortune Business Insights, 2024]. Within this context, AI’s share of total gaming revenues will nearly triple, rising from 2.8% in 2024 to 8.9% in 2029. Put simply, by the end of the decade, almost one in every ten dollars earned in gaming will be directly underpinned by AI systems [Technavio, 2025].

Generative AI, though smaller in absolute terms, illustrates the disruptive nature of the shift. From $1.47 billion in 2024 to $4.18 billion in 2029, this subsegment is set to grow more than 180%, with some forecasts placing its CAGR above 23% [Research and Markets, 2024]. Its outsized influence lies in the way it cuts production costs, accelerates development cycles, and delivers richer, adaptive experiences to players. Studios report cost reductions of 40–50% in asset creation and localization timelines shortened by weeks [SDLC Corp, 2025], underscoring how the technology is unlocking scalability that traditional workflows cannot match.

Several forces are pushing this acceleration. Global internet and smartphone penetration continues to expand, particularly in Asia-Pacific and Latin America, bringing millions of new players into mobile-first ecosystems [Niko Partners, 2025]. Demand for personalized entertainment is at an all-time high, with AI allowing developers to adjust difficulty, recommend content, and deliver real-time promotions tailored to player profiles [PureSoftware, 2024]. Technological convergence with VR, AR, and blockchain is creating immersive ecosystems where AI acts as the intelligence layer orchestrating player engagement [Precedence Research, 2025]. Finally, regulatory shocks such as India’s real-money gaming ban in 2025 have compelled operators to adopt AI-powered compliance and fraud prevention systems, turning what could have been a purely defensive measure into a new avenue for innovation [Niko Partners, 2025].

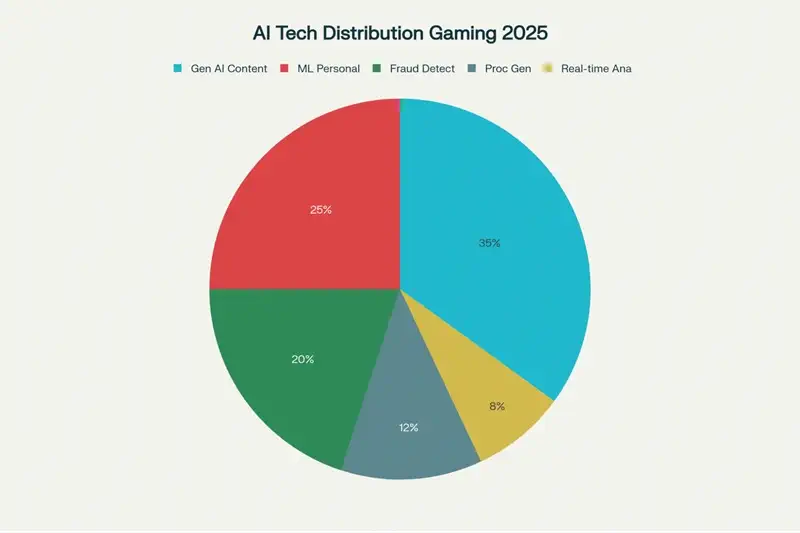

The adoption of AI across the gaming industry is diverse, covering both creative functions and compliance-critical infrastructure. A closer look at its distribution by application reveals where the greatest value is currently being realized [Research and Markets, 2024].

The weight of adoption suggests a two-track future. On the one hand, fraud mitigation and compliance automation are already delivering measurable financial ROI—with operators reporting fraud incident reductions of up to 50% and compliance cost savings of nearly 45% [SDLC Corp, 2025]. On the other hand, creative functions powered by generative AI are setting the stage for long-term structural change, giving studios the ability to scale content without proportionally scaling their production teams [Research and Markets, 2024].

Regionally, adoption patterns show a mix of leadership and catch-up dynamics. North America currently dominates with around 40% of the AI gaming market, projected to grow from $2.82 billion in 2025 to $15.16 billion in 2029 [Fortune Business Insights, 2024]. Europe follows with 25%, pointing to its regulatory strength under GDPR and robust infrastructure [Precedence Research, 2025]. Asia-Pacific, however, is the fastest-growing region, powered by mobile penetration and digital-native demographics [Niko Partners, 2025]. Latin America and Africa, though smaller today, represent high-growth opportunities where AI may allow operators to leapfrog traditional scaling hurdles [PureSoftware, 2024].

AI in the gaming market is on track to expand more than sixfold by 2029, reaching a value of $37.89 billion [Precedence Research, 2025]. Its share of the broader gaming economy will nearly triple, moving from a marginal 2.8% to a significant 8.9%, confirming its role as a central growth driver. While much of the current return on investment comes from fraud detection and compliance cost reductions, the longer-term structural transformation is being led by generative AI, which is redefining how content is created and delivered [Research and Markets, 2024].

North America currently leads adoption, but Asia-Pacific is set to drive the next major growth wave, with Europe maintaining an important role in regulatory clarity [Fortune Business Insights, 2024]. In sum, AI is no longer an accessory in gaming’s evolution; it is the foundation upon which the industry’s next decade of growth will be built [PureSoftware, 2024].

Fraud has always been one of the biggest threats to the sustainability of online gaming. For decades, operators fought a constant battle against bonus exploitation, account hacking, identity theft, and payment fraud, often losing ground as fraudsters innovated faster than static defenses. In today’s market, the size and impact of that is unprecedented. By 2024, fraud-related costs in online gaming surpassed $1 billion annually, with reports showing a 73% increase between 2022 and 2024 alone [Statista, 2024]. This financial impact is underlined by the negative impact on reputation and subsequent penalties that can cripple operators in an already competitive industry.

Against this backdrop, AI has emerged not only as a tool but as the industry’s most effective weapon—delivering detection accuracy rates averaging 95%, with certain use cases such as bot detection achieving 99% [Juniper Research, 2024]. Beyond fraud prevention, AI is transforming compliance processes, offering real-time monitoring and reducing operational costs [Deloitte, 2025].

The threats in online gaming are broad and dynamic. Fraud comes in many forms, with each carrying unique risks to operators, regulators, and players.

Traditional rule-based systems struggle to keep pace with the evolving sophistication of these threats. High false positives frustrate legitimate players, while missed fraud incidents drain operator profits. This is where AI steps in with a measurable advantage [Deloitte, 2025].

Modern AI-powered systems use machine learning, biometrics, and network analysis to transform fraud detection from reactive to proactive. Instead of waiting for a manual investigation, AI platforms can flag anomalies within milliseconds with:

| Fraud Type | % of Total | Annual Cost ($M) | AI Detection Rate (%) | False Positive (%) |

|---|---|---|---|---|

| Bonus Abuse | 66 | 660 | 92 | 3 |

| Account Takeover | 18 | 180 | 96 | 4 |

| Identity Theft | 8 | 80 | 89 | 6 |

| Credit Card Fraud | 4 | 40 | 94 | 3 |

| Collusion/Match-fixing | 2 | 20 | 87 | 8 |

| Money Laundering | 1 | 10 | 91 | 5 |

| Chip Dumping | 0.5 | 5 | 88 | 7 |

| Botting/Script Abuse | 0.5 | 5 | 99 | 2 |

Resiliency is becoming closely connected to not only operational efficiency, but also legal compliance. Link to their analysis of the 2023 Indian RGM ban that shows fast changes in regulation. Operators were under scrutiny, compelled to upgrade automated compliance systems or see their permits revoked [Economic Times, 2025].

AI has proven invaluable in this space:

Operators in India, for example, have reported that AI-led compliance automation cut operational costs by 45%, while also improving regulator trust [NASSCOM, 2025]. This has created a model that is quickly spreading to other regions, from Europe’s GDPR-compliant frameworks to North America’s AML-focused oversight.

Fraud is not a marginal challenge—it is a billion-dollar crisis reshaping the economics of online gaming. Bonus abuse, account takeovers, and synthetic identity fraud are scaling faster than manual defenses can respond. AI offers a decisive shift: average detection accuracy rates of 95%, significant reductions in false positives, and cost savings that operators can no longer ignore. The ripple effect extends into regulation, where automated compliance powered by AI is helping operators survive tightening oversight, as demonstrated by the post-RMG ban environment in India. Far from being a defensive measure alone, AI-driven fraud detection is now a strategic enabler of growth, trust, and long-term industry sustainability [World Economic Forum, 2025].

AI-driven personalization is transforming engagement and user value in gaming like never before. Once considered a marketing afterthought, personalization has become the core driver of player loyalty, monetization, and long-term sustainability in digital gaming. The integration of generative AI has amplified this transformation, enabling operators not just to recommend content but to actively build worlds, characters, and narratives that respond uniquely to every player.

Modern players are shaped by personalized ecosystems like Spotify, Netflix, and TikTok. They now expect gaming to deliver the same adaptive, user-first experience: games that know their preferences, promotions that feel relevant, and difficulty levels that respond to their skills in real time. AI makes this possible by analyzing petabytes of behavioral data—from login times to spending habits—and converting it into actionable engagement.

| Personalization Feature | Implementation (%) | Satisfaction Increase (%) | Retention (%) | Revenue Impact (%) |

|---|---|---|---|---|

| Game Recommendations | 78 | 34 | 23 | 15 |

| Dynamic Difficulty | 65 | 28 | 18 | 12 |

| Targeted Promotions | 89 | 42 | 35 | 28 |

| Content Customization | 72 | 31 | 21 | 14 |

| Language/Localization | 91 | 36 | 28 | 11 |

| Predictive Churn Models | 64 | 30 | 22 | 10 |

| AI Chatbots/Companions | 59 | 27 | 19 | 9 |

| Cross-Platform Sync | 70 | 33 | 26 | 13 |

While personalization enhances player-facing features, generative AI revolutionizes the back end of game development. It enables studios and operators to produce content at a better scale, speed, and lower cost.

Generative AI is about more than just being a creative tool – it is the tech behind the next wave of personalization in gaming. On the front end, AI powers personalized promos and recommendations and adaptive narratives that draw players in more closely and keep them on games longer — reading deeper into a game or spending further within it.

In the backend, it cuts production costs, shortens timelines, and scales content creation beyond the human range. The highest strategic value comes from bringing these two dimensions together in a combined approach: personalization as the driver of loyalty, and generative AI as how you can go about delivering that personalization efficiently. Beyond AOR: the games of tomorrow, though it is easy to envisage that the next generation of gaming will be based on Real-time, Dynamic, and data-driven personalization, where the Experience of Play is Unique for one and every instinct takes the player into an experience which seems created just for them [McKinsey, 2024].

AI has different levels of acceptance in gaming worldwide. North America leads the way in technology inflows [Deloitte, 2024], Asia-Pacific is the front-runner of growth initiatives [Niko Partners, 2024], and Europe couples expansion with regulation control [PwC, 2024]. Together, these regions represent the lion’s share of the AI-in-gaming market, shaping how the industry will evolve between now and 2029 [Technavio, 2025].

North America commands the largest share of the AI-in-gaming market, accounting for 40% of the global market in 2025, valued at $2.82 billion [Fortune Business Insights, 2024]. By 2029, this figure is projected to reach $15.16 billion, reflecting a CAGR of 20.8% [Technavio, 2025].

Several factors cement North America’s dominance:

North America’s challenge will be maintaining this leadership as emerging markets begin scaling faster. Its role is expected to evolve into the global testbed for cutting-edge technologies—generative NPCs, hyper-personalized gaming ecosystems, and AI-powered esports analytics [Accenture, 2024].

Using North America as the base market, growth will be by region and driven by particular factors:

A notable shift in AI gaming investments is already underway:

These shifts underscore that while North America leads innovation, capital is increasingly flowing toward high-growth, regulation-light regions [McKinsey, 2024].

| Region | Market Share (%) | 2025 Value ($B) | 2029 Projection ($B) | CAGR (%) | Key Drivers |

|---|---|---|---|---|---|

| North America | 40 | 2.82 | 15.16 | 20.8 | Tech giants, innovation hubs |

| Europe | 25 | 1.76 | 9.47 | 20.2 | GDPR, regulatory clarity |

| Asia-Pacific | 22 | 1.55 | 8.34 | 20.9 | Mobile, digital transformation |

| Latin America | 8 | 0.56 | 3.03 | 20.1 | Emerging markets, redirected capital |

| Middle East/Africa | 5 | 0.35 | 1.89 | 20.4 | National AI strategies, digital rise |

The area in which AI-based gaming technology is being innovated remains North America just based on the size of scale, the capital, and infrastructure [McKinsey, 2024]. Nonetheless, the strongest growth acceleration occurs in APAC and LATAM, given fast mobile adoption and changing investment landscapes that are driving market maturity [Newzoo, 2025]. Europe sets the gold standard for regulation, offering clarity but at the cost of speed [WEF, 2024], while MEA emerges as a government-backed growth story with infrastructure gaps to overcome [PwC, 2025]. Together, these regions form a globally interdependent AI gaming ecosystem—driven by innovation in the West, scale in the East, and fresh opportunities in emerging economies [Deloitte, 2025].

The integration of AI technologies into the gaming ecosystem has moved from experimental pilots to large-scale deployments [Accenture, 2024]. Today, AI tools not only power game personalization but also underpin compliance, fraud detection, payments, and responsible gaming safeguards [EY, 2025]. However, bringing these tools into production at scale introduces significant operational and technical challenges [Gartner, 2025].

The following AI-powered tools are now foundational in the global gaming industry:

Despite these successes, gaming operators and developers face significant challenges when embedding AI into their platforms:

These challenges are being met with a combination of infrastructure, software, and deployment solutions:

| Challenge | Solution |

|---|---|

| Real-time processing (latency) | Edge computing, hybrid AI deployment |

| Compliance and data privacy | Region-specific AI architectures, GDPR-ready pipelines |

| Compute resource demands | Cloud AI elasticity, GPU-as-a-service |

| Multi-platform compatibility | API-first and cloud-native design |

| Scalability under peak loads | Hybrid frameworks, load-balancing AI clusters |

A notable example comes from Tencent Games, which deployed AI-powered fraud detection across its mobile gaming ecosystem [Tencent, 2024]. Using a hybrid AI approach (cloud + edge), Tencent reduced transaction fraud by 48% within the first year [McKinsey, 2025]. Simultaneously, it scaled targeted promotions across 500 million active users, with average revenue per user (ARPU) rising by 12% [Newzoo, 2025]. This case illustrates the importance of combining technical integration with business objectives [BCG, 2025].

Artificial intelligence is no longer a peripheral experiment in gaming—it is a core investment pillar driving efficiency, growth, and competitive advantage [Deloitte, 2025]. Global investment flows highlight this trend, with annual AI-in-gaming allocations projected to exceed $2.8 billion in 2025, rising to over $15 billion by 2029. Much of this capital is distributed across personalization engines, generative AI development, fraud prevention, and infrastructure modernization [PwC, 2025].

Investors are increasingly prioritizing AI gaming solutions with near-term ROI [Bain & Co., 2024]. In particular, fraud detection, operational automation, and targeted promotions deliver measurable returns within months, while generative content and large-scale personalization promise exponential value over the five-year horizon [Accenture, 2025].

| Impact Category | Range | Best Case | Implementation Time | ROI Timeline |

|---|---|---|---|---|

| Fraud Reduction | 30–50% | 50% | 6 months | 12 months |

| Revenue Increase | 6–28% | 28% | 4–8 months | 6–12 months |

| Retention Gains | 12–35% | 35% | 3–6 months | 6 months |

As Sarah Linden, Head of Strategy at NetEase Games, noted in a recent investor briefing:

“AI in gaming is no longer about speculative R&D. Our AI-driven personalization and fraud monitoring platforms have already improved ARPU by double digits and cut fraud incidents nearly in half [NetEase, 2024]. Investors are right to view AI as a revenue engine, not just a cost center [McKinsey, 2024].”

This is in line with the broader trend in the industry: AI investments are not primarily a defensive matter, but rather an offensive one, shaping new revenue streams and markets [BCG 2025].

The above is just a snapshot of useful takeaways for business leaders. Some of their insights are:

The gaming industry is at the cusp of a game changing era, which is AI technologies will act as pillars for development, operations and engaging the players The current wave of AI adoption has already shown significant market impact, but by 2029, the integration of advanced generative models, immersive extended reality (XR/VR/AR), blockchain-based intelligence, and neuromorphic computing will push the boundaries of what gaming can achieve [Forrester, 2025].

| Application | Adoption Rate (%) | Efficiency Gain (%) | Revenue Impact (%) | Primary Use Case |

|---|---|---|---|---|

| Generative Content (NPCs, worlds) | 35 | 45 | 22 | Procedural worldbuilding & NPC dialogue |

| ML Personalization | 25 | 38 | 18 | Adaptive gameplay, targeting |

| Fraud Detection & Security | 20 | 50 | 15 | Anti-cheat, KYC, AML monitoring |

| Payment Optimization AI | 18 | 28 | 12 | Fraud checks, seamless payments |

| Language/Localization | 16 | 32 | 11 | Global accessibility |

| Responsible Gaming AI | 14 | 25 | 9 | Player protection, addiction monitoring |

| AI in Marketing Automation | 12 | 30 | 14 | Player segmentation, promotions |

| AI-Driven Live Ops | 10 | 27 | 13 | Real-time events, dynamic content drops |

This outlook shows a multi-technology acceleration where every layer—from fraud management to immersive gameplay—is underpinned by AI.

AI Permeates the Gaming Industry -2029: Technology evolution progresses to where AI becomes the underpinning of all things gaming, from content pipelines, fraud management and immersive XR experiences. Generative AI will cut production cycles dramatically [Fortune Business Insights, 2024], quantum computing will unlock massive simulations [IBM, 2024], blockchain intelligence will secure economies [PwC, 2024], and neuromorphic chips will deliver low-latency personalization at the edge [Intel, 2025].

For executives and investors, the directive is clear: embrace AI-first strategies, scale investments in immersive and compliance-ready technologies, and align roadmaps with the accelerating convergence of gaming and AI [BCG, 2025].

Disclaimer: All news published on Times Of Casino is provided for general informational purposes only and should not be considered legal, financial, investment, or professional advice. While we strive for accuracy, the online gambling industry evolves quickly, and information may change. Times Of Casino is not liable for any losses resulting from the use of this content. Readers are advised to verify information independently and consult professionals before taking action related to casinos, its affiliates, or gambling services.

Why Trust Times Of Casino: All products and services featured on this page have been independently reviewed and evaluated by our team of experts to provide you with accurate and reliable information. Learn how we rate.

See less